Have you ever been confused about which financial professional you need for your business? There are so many to choose from: Certified Financial Planners, Certified Public Accountants, Enrolled Agents, accountants, bookkeepers, controllers, and Chief Financial Officers. Just as all doctors should not perform heart surgery, CPAs and other financial professionals are not one-size-fits-all!

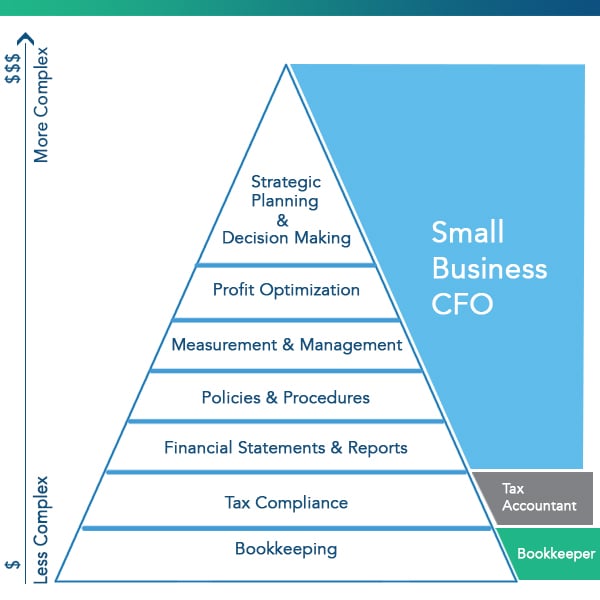

This distinction between different accounting functions can be somewhat confusing in the small business space. Therefore, we want to share our Hierarchy of Accounting Needs. Borrowing from the concept of Maslow’s Hierarchy of Needs, there is also a hierarchy of needs for business accounting needs. The base is the foundation and represents the most basic and fundamental need. As your business matures and grows, the needs change and grow as well. The diagram below depicts the hierarchy, and detail on each tier is expanded below.

Level 1: Bookkeeping

This is the base of the accounting needs. It’s good to remember that “bookkeeping” is synonymous with “record keeping”. This is the function that tracks all the transactions in the business and categorizes those transactions into the proper account for accounting records. It’s like professional organization for your business financial transactions! Without business activity, you won’t need a bookkeeping system.

A bookkeeper is the role that should be hired to take care of this need. This is the first person to hire if you have a shoebox full of receipts stuffed into a closet!

Level 2: Taxes & Compliance

Taxes don’t need to be filed until you have some business activity, but you need your transactions to be recorded and organized to file taxes. Therefore, Tax & Compliance is our second level need in the hierarchy. Taxes (local, state, and federal) are required for businesses that are active. Without having your tax and compliance needs met, you could jeopardize your ability to continue in business (the taxing authorities could shut you down if you don’t file and pay).

Along with tax compliance, most businesses also need to comply with legal and regulatory bodies. Without proper licensing to operate, a business will get shut down or incur major fines and fees.

A Tax CPA or Enrolled Agent should be hired to take care of the needs at this level. Usually tax CPAs can provide assistance or advice with business licenses, but some may refer you to a lawyer. Don’t rely on a CPA to know all the ins-and-outs of industry-specific compliance needs if they are outside of the financial function of the business.

Level 3: Financial Statements & Reports

The financial statements (Balance Sheet, Income Statement, and Statement of Cash Flows) are the result of proper bookkeeping and accounting entries. These are used to present financial information to the owners of the business in a consistent format for a specific time period. This financial need is crucial in the financial oversight and understanding of the business operations. This is the stage where you might look at the financials and say, “Wow, it looks like our profits are strong and net cash is good. It may be a good time to take a dividend.” Or maybe, “We spent HOW MUCH on marketing!?” or “I thought we had more cash than that!” The financial statements answer questions and provide insight to business owners.

If your business is actively spending and making money, you need to be looking at financial statements. We recommend a monthly financial statement review. The trick with financial statements is that they don’t really matter to business owners unless the owner knows how to read them. You can look at them, but if they cause your head to spin, you should get some help with interpretation.

A Small Business CFO is the role that can help interpret financial statements into usable information. No more head-spinning, just clear answers.

Level 4: Policies and Procedures

When a business gets to a complexity level where it is interacting with many employees, vendors, and customers, it’s time to make sure you have financial policies in place. Policies can be about how to handle cash, how to handle late customer payments, how employees earn paid time off and sick leave, who can sign checks, etc. The more entities your business interacts with, the more imperative financial policies become. This is the key CONTROL layer in our hierarchy, as the need establishes what SHOULD be done.

Procedures provide the step-by-step instructions for the employees to execute their jobs according to the policies that have been set.

A Small Business CFO is the role that can help identify where there is a lack of financial policies. They can also suggest best-practice for procedures to help optimize cash flow and minimize the risk of theft & waste.

Level 5: Measurement & Management

The next level in the hierarchy involves measuring the company’s results and managing them. This includes measuring actual financial results to a budget, setting-up and tracking Key Performance Indicators (KPIs), and performing analysis on the numbers. It also includes interpreting the results of the measurement and discussing with the business owner so informed decisions can be made.

A Small Business CFO is the role that can help set up budgets, forecasts, & KPIs for tracking. The CFO can also perform the comparisons and note any changes that are out of the ordinary or trending in a positive or negative direction. One of our mantras is “what gets measured, gets managed”, and we have seen this to be true in our work with clients.

Level 6: Profit Optimization

Maximizing profit may not be the ultimate goal for some small businesses, but having a health profit can enable a business to accomplish its goals! Businesses can increase profit by increasing revenue or decreasing expenses (or a combination of both). This need in the hierarchy really should permeate the entire pyramid because optimizing profit should be happening at all levels. We encourage owners to watch expenses and increase revenue, no matter where they are on their journey.

However, as complexity rises in a business, there’s a high likelihood that there may be too many transactions for an owner to keep an eye on, and “expense creep” can set in. A deep-dive expense analysis should be performed to seek out un-helpful expenses that aren’t providing the business any return (both financial and non-financial).

Additionally, sometimes entire revenue steams or business segments need to be cut to optimize profits. A novice looks only at revenue and not profit as well. We have an example below. In Scenario 1, the company has three products and monthly revenue of $9,000. However, we see that Product B is actually costing the company money (and profit). Therefore, in Scenario 2, we cut product B entirely, and profit INCREASES even though revenue decreases.

A Small Business CFO is the role that can help owners see what expenses are not helping them and where they can increase revenue. This is the level where we nail down the ideal operating level so that the business can achieve the goals that have been set.

Level 7: Strategic Planning and Decision Making

At the top of the pyramid, the Small Business CFO provides more than financial know-how to the business owner. This is where the CEO or owner has a counterpart in decision making – someone who’s got their back and provides counsel. The CFO can provide strategic insights based on the plans, forecasts, and planning tools that are developed and customized for the business. You may find yourself with questions like: “How can I reach my 5-year revenue goal?”, “How do I retain key employees?”, or “How do I plan for an economic downturn?” These are just a few areas where a CFO could support this financial need.

A Small Business CFO is the role that can help be a teammate and counterpart to the CEO/owner. The CEO is like the captain of a ship and steers it to where he wants to go. The CFO is the navigator who advises the captain on the best path to arrive at the destination safely and efficiently.

What’s the Next Level for You?

Are you ready to gain control and clarity in your business finances? Ready to take the next step to maximize profits and make confident financial decisions? We’d love to talk with you about your financial needs and help you make a path to your goals. Let’s talk.

Disclaimer: This blog and the linked videos are intended for educational purposes and should not be taken as legal or tax advice. You should consult with your financial professionals about your unique financial situation before acting on anything discussed in these videos. Clara CFO Group, LLC is providing educational content to help small business owners become more aware of certain issues and topics, but we cannot give blanket advice to a broad audience.